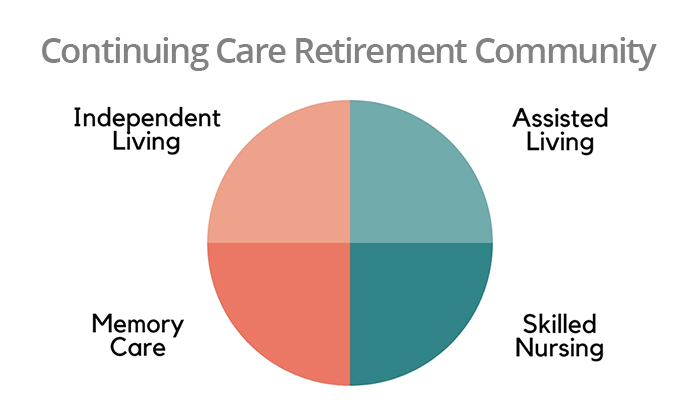

A CCRC, or continuing care retirement community, answers the desire to “move just once.” Rather than relocate several times over the course of aging, your loved one can stay on one campus. Even as care needs change.

Typically, residents start by moving in to an independent living unit with no support services. When help is needed, they can step up to an assisted living unit. There they are relieved of cooking, cleaning, and more. A memory care unit serves those with dementia. A skilled nursing unit houses those who need 24/7 access to medical attention or rehabilitation.

These communities are typically rich in amenities and resident activities. They are particularly appealing to couples. Mates can live close to each other and visit easily. Convenient when one is totally independent and the other needs care.

Biggest drawback? Expense

CCRCs require a hefty entrance fee—usually in the six figures. And there are monthly fees as well, often quite high. Medicare covers expenses only in very limited circumstances and for a very limited time.

Given the steep entrance fee, it’s important to verify the financial stability of the company running the CCRC. If it goes bankrupt, all that money may be lost.

It’s also wise to have an attorney and a tax advisor review the CCRC contract. Some of the fees may be tax deductible. Take special note of refund options should your loved one want to leave. And find out what happens to the entrance fee upon your relative’s passing. Also, if there are monthly fee obligations until a new resident is found for the unit.

Give it a test

Have your loved one spend at least a few nights on campus before making a commitment. Be sure it’s a good fit. A CCRC is a long-term investment.